Founders, hang in there

It’s a tough time right now, but there’s a big opportunity for those who stick with it

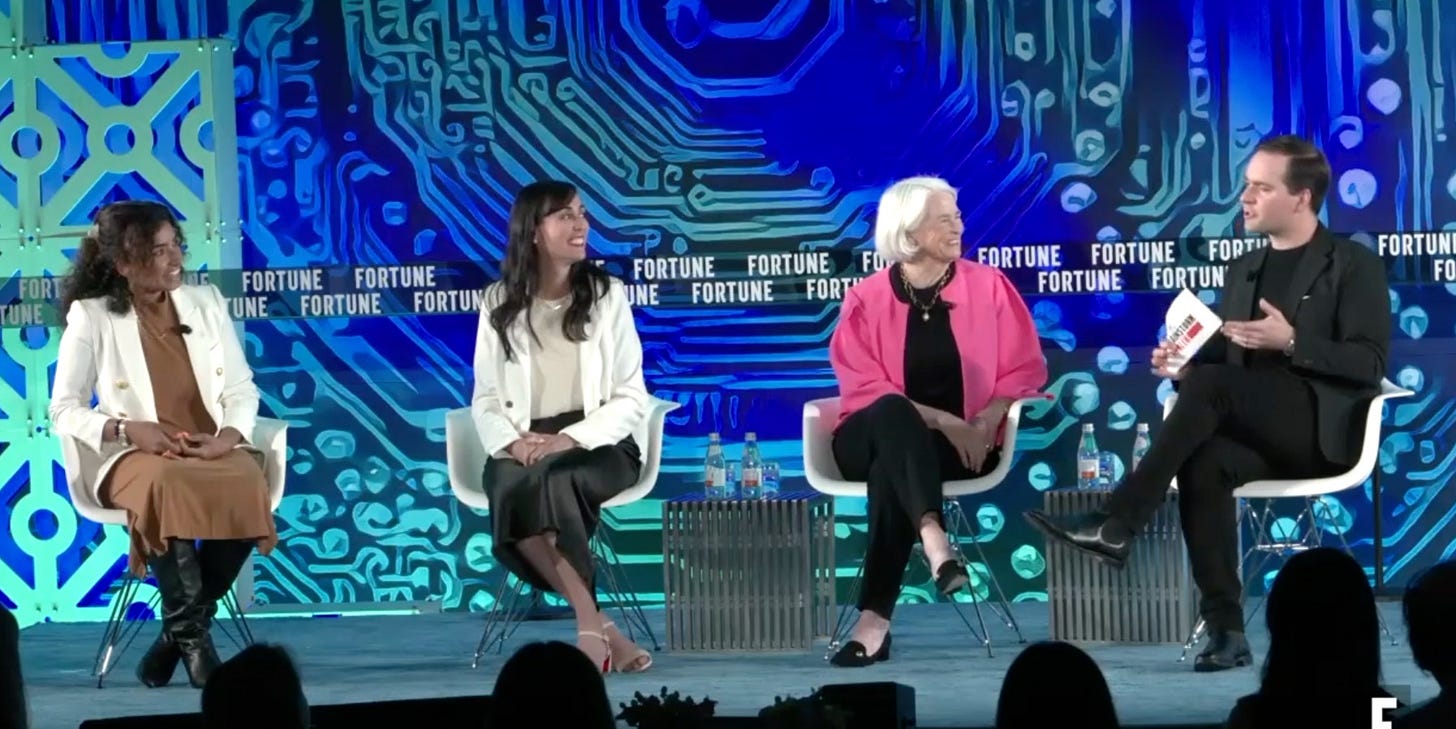

Last week, I flew out to Los Angeles to speak on a panel with a group of investors about what we’re all seeing in the market. That was a special opportunity for me to reflect, given how busy it’s felt the past few months. The panel kicked off with Fortune Magazine moderator Andrew Nusca reading from a report claiming that it’s hard not to have a “glass half empty” attitude if you’re looking at health-tech investment opportunities.

My fellow panelists - GV’s Cathy Friedman and 7wire’s Alyssa Jaffee - both agreed that they’re feeling optimistic. Not because the market is up or funding is easy to come by, particularly at the growth stages, but because this is going to be the time period that produces the best companies. I am certain of that.

As I shared with Fortune, there’s a new discipline that I’m seeing versus the 2020-2022 period. The heyday of digital health - in the pandemic years - brought plenty of cash to the sector, but it also meant that companies could burn too much, grow too quickly and avoid making hard decisions. The quality and caliber of companies I’m seeing now is night and day.

Some of the most common mistakes I saw, particularly with the virtual clinic businesses in that period:

Rushing to launch nationwide or in too many states too early;

Opening up too many lines of care before nailing the core use-case;

Hiring very experienced medical professionals too soon and having them wait around;

And on a related note, not being disciplined around matching clinical capacity with the number of patients coming in the door.

Because of the resiliency required to make it in 2024, founders who survive this tougher market will build the generational companies of tomorrow. These companies will also be better suited to the public markets, because they were more sustainable from the beginning versus purely being focused on their mission or a growth mindset.

“What investors are looking for is different from what they used to look for in the past,” said Jaffee on stage. “I’ve not heard so many conversations about profitability in all my years of being a venture capitalist than I have in the last 18 to 24 months.”

Let me be clear. None of this is easy. Also at the conference, I chatted with entrepreneurs who told me they were taking more than 100 meetings with investors before finding a lead. That is far too many and is frankly a massive waste of time. 100 hours of meetings is several months of time. A founder could have used that time to operate, instead of talking to VCs.

I also heard stories from founders saying that it feels like the goal posts keep moving with VCs. They were told to have a product built to raise a seed, then they were told to have $1M in ARR, in addition to payer contracts or a minimum number of covered lives. Sitting on the other side of the table, I do admit that the bar is higher than ever, oftentimes too high. What was once a Series B is now a Series A, just as an example.

To shed some light into our world on the other side, investors are concerned about upstream financing, so the last thing they want to do is anchor at a high valuation in an earlier round only to have to take a flat round or worse, a mark down. As VCs, it’s also our job to create liquidity, or dollar returns for our limited partners (LPs). And with the M&A market tightened up and the IPO market not yet humming as it was a couple years ago, that’s been hard to come by. This makes VCs more hesitant to invest, even if they want to.

I also know that many of my fellow VCs are facing the same thing, and it’s harder than ever to raise from LPs in this climate. We’re all working harder, but we’re also working smarter.

Finally, I believe that the clinical outcomes we will see are going to be better than ever, given that the bar is also higher for payers and providers before they sign contracts. Bottom line: We will see far fewer companies with “growth at all costs” mindsets, and we’re all better off because of it.

Here’s a link to the video discussion for those who couldn’t attend in person.

It goes without saying but if you’re building in consumer health, please don’t hesitate to reach out. I’d love to meet with you!

Prediction in science is based of facts, experiments and proof, in the business it is not so. The data is too much, too much randomness and there is no way one can do an experiment. It has to be lived through. In this scenario prediction is really tough. After reading this article I also felt quite confident. Very well done Anarghya!! May your optimism continue and hold good.